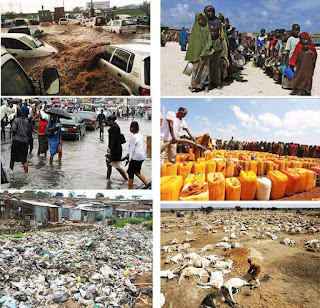

Disappearing

forests, pollution of Marine life and degradation of land deprive the East

African economy of as much as billions of dollars, of which Forest Loss constitute $75 million of income

a year, about five times the amount the country earns from forestry and

logging, the United Nations Environment Programme (UNEP)and state-run Kenya

Forest Service (KFS)said in 2014. Deforestation has also disrupted natural

water-movement cycles into lakes and rivers, the agencies said. It should be

remembered that 80% of the Earth’s above-ground terrestrial carbon and 40% of ibelow-ground terrestrial carbon is in forests. Forests aid in Carbon

Sequestration: a natural or artificial process by which carbon dioxide is

removed from the atmosphere and held in solid or liquid form in long-term to

either mitigate or defer global warming and avoid dangerous climate change.This

is where carbon Credit find its place.

WHAT IS CARBON CREDIT/TRADE ?

Photo credit ; KFS Portal

According

to the Collins English Dictionary, carbon credit refers to a certificate

showing that a government or company has paid to have a certain amount of

Carbon dioxide (CO2) removed from the environment. This means that an

organization or individual has an allowance of credits which gives them the

right to emit one metric tonne of CO2 or any other greenhouse gas.

A carbon

credit is a permit that allows a country or organisation produce a certain

amount of carbon emissions and that can be traded if the full allowance is not

used.

The

emissions trading system allows countries or companies with higher carbon

emissions to purchase the right to release more carbon dioxide into the

atmosphere from those with lower emissions. The developed ( industrialized)

countries engaging developing countries to help reduce carbon emission.

The concept

of being paid for protecting the environment from greenhouse gases, such as

carbon dioxide, methane, Chlorofluorocarbons(CFCs)

and nitrous oxide,

dates back to Japan’s 1997 Kyoto Protocol. This international agreement is

observed by at least 170 countries of the 193 states recognized by the United

Nations. Kenya being one of them.

Under the

protocol, caps were placed on the greenhouse gas emissions industrialized

countries were permitted to emit. Those that exceeded their limit (one metric tonne)

however, could buy "credits" from other member nations whose

emissions fell below their target levels. It sought

to commit countries to reduce greenhouse gas emissions by at least 5%. The key

aim of carbon emissions trading, involving carbon "credits" was to

provide economic incentive to those taking care of the already ailing*

environment.

Having been

laid out in the UN's Kyoto Protocol, an international treaty that came into

force in 2005 to help mitigate climate change, carbon trade strategies'

implementation became very imperative.

Since the December

2009 Copenhagen Climate Change Summit, interest in forest carbon trading has

been on the rise largely due to its huge benefits, financially.

The concept

was then extended to private companies (and even individuals), which could earn

credits for reducing their carbon emissions by engaging in sustainable

practices such as using solar power instead of coal or gas or protecting trees.

Carbon emitters could buy those credits on a voluntary basis to offset their

own pollution.

REDD+ , THE FOREST CARBON PARTNERSHIP FACILITY.

REDD+ stands for Reduce Emissions from Deforestation and forest Degradation efforts and to foster conservation, sustainable management of forests, and enhancement of forest carbon stocks in developing countries. It was first negotiated under the United Nations Framework Convention on Climate Change (UNFCCC) since 2005, with the objective of mitigating climate change through reducing net emissions of greenhouse gases through enhanced forest management in developing countries. Most of the key REDD+ decisions were completed by 2013, with the final pieces of the rulebook finished in 2015. Deforestation and forest degradation are the second leading cause of global warming, responsible for about 15% of global greenhouse gas emissions, which makes the loss and depletion of forests a major issue for climate change.

THE CARBON MARKET

The carbon

market, estimated to be worth $176 billion, has attracted various stakeholders

including farmers. The United Nations Framework Convention on Climate Change

(UNFCCC) has registered over 3,927 Clean Development Mechanism (CDM) projects

in the world with only 84 of such projects in Africa, a clear indication that

Africa needs to tap into the industry for development.

CARBON CREDIT

PRICES

Prices for carbon credits reached an all-time high in July 2008 at 36.43 euros ($50.17) per tonne under the European Union’s carbon market, the world’s biggest.

The cost of carbon sequestration varies from region to region, and also from country to country, based on different economic analyses. Phat et al. (2004) estimated the cost of carbon at around US$ 19.7 per Mg C in Southeast Asian countries. Kirschbaum (2001) assumed a cost of US$ 10 per Mg C for indefinite carbon savings in different arbitrary accounting periods. Missfeldt and Haites (2002) used a 1995 cost of US$ 15 per Mg C for a sink enhancement scenario, and Tschakert (2002) used a cost of US$ 15 per Mg C for her study in Senegal. In other studies, it ranged from US$ 1 to 100 (Healey et al., 2000; CIDA, 2001; Niles et al., 2002).There is no study on prices of carbon credits from forests in Kenya but it can be assumed from the above findings that the price would range from US$ 15 per Mg C based on the scenarios in Southeast Asian countries and Senegal, assuming the same socio-economic conditions.

Prices for carbon credits reached an all-time high in July 2008 at 36.43 euros ($50.17) per tonne under the European Union’s carbon market, the world’s biggest.

The cost of carbon sequestration varies from region to region, and also from country to country, based on different economic analyses. Phat et al. (2004) estimated the cost of carbon at around US$ 19.7 per Mg C in Southeast Asian countries. Kirschbaum (2001) assumed a cost of US$ 10 per Mg C for indefinite carbon savings in different arbitrary accounting periods. Missfeldt and Haites (2002) used a 1995 cost of US$ 15 per Mg C for a sink enhancement scenario, and Tschakert (2002) used a cost of US$ 15 per Mg C for her study in Senegal. In other studies, it ranged from US$ 1 to 100 (Healey et al., 2000; CIDA, 2001; Niles et al., 2002).There is no study on prices of carbon credits from forests in Kenya but it can be assumed from the above findings that the price would range from US$ 15 per Mg C based on the scenarios in Southeast Asian countries and Senegal, assuming the same socio-economic conditions.

RULES FOR SALE

The CDM

allows the possibility of trading carbon offsets from forestry or land-use

projects (at least from reforestation and afforestation activities) through the

Article 12 (the CDM or CERs‘ from developing countries). The sale of carbon

credits are done under the Kyoto Protocol of 2005, more information can be

obtained from the links embedded below.

CARBON CREDIT/TRADE

STATUS IN KENYA

Data from

the Ministry of Finance shows that only seven projects are currently registered

for carbon credit trading in Kenya.

WHICH COMPANIES IN

KENYA

Mumias

Sugar Company, East Africa Portland Cement Company and Kenya Power as well

other smaller companies are among institutions participating in the carbon

credit trading market. KenGen is counting on its continued geothermal,

energy-capacity expansion programme and the existing potential for emission

reduction to expand its carbon credit assets.

WHICH PROJECTS IN

KENYA

They include a

35-megawatt electricity co-generation project by Mumias Sugar Company, the

Olkaria II and III Phase 2 geothermal development projects, the

yet-to-be-constructed Lake Turkana Wind Power project, and the Mount Kenya

Small Scale Reforestation initiative. Others are the redevelopment of the Lake

Turkana hydropower station project and the Kirimara Kithithina rehabilitation

project in the Aberdares.

The

majority of the voluntary carbon projects in Kenya are in the forestry

sector. Currently, there are nine

forestry sector voluntary projects that include the Kasigau Corridor REDD

Project Phases I (Rukinga Sanctuary) and II (the Community Ranches); the

International Small Group & Tree Planting Programme (TIST); Aberdare

Range/Mt. Kenya Small Scale Reforestation Initiative; the Forest Again Kakamega

Forest; Mikoko Pamoja Mangrove Restoration; the Enoosupukia Forest Trust

Project; Treeflights Kenya Planting Project; the Chyulu Hills REDD+ Carbon

Credit Program; and the Mbirikani Carbon, Community and Biodiversity Project.

These projects are at various stages of development.

Benefit Reaped

Already

So far,

KenGen, Mumias Sugar, East Africa Portland Cement and Kenya Power have reaped

from the credits by negotiating one-on-one with international buyers. Mumias

Sugar was the first Kenyan firm to sell carbon credits, making Sh22 million in

2010. This was followed by Kenya Power which sold 700,000 credits to Standard

Bank. Also Sustainable Agriculture Land Management project in Kenya, working

with western Kenyan farmers.

The biggest

beneficiary has been KenGen, which in two years to 2015 earned about Sh270

million by selling its credits through the World Bank’s Emission Reduction

Purchase Agreements. According to the firm’s Chairman Joshua Choge, the revenue

from the credits is shared with local communities where KenGen operates. They

include a 35-megawatt electricity co-generation project by Mumias Sugar

Company, the Olkaria II and III Phase 2 geothermal development projects, the

yet-to-be-constructed Lake Turkana Wind Power project, and the Mount Kenya

Small Scale Reforestation initiative. Others are the redevelopment of the Lake

Turkana hydropower station project and the Kirimara Kithithina rehabilitation

project in the Aberdares

In 2012, Carbon Manna Unlimited was pushing forward an ingenious pilot project that rewards small scale farmers in Mbeere and Bungoma districts for planting trees and using more energy efficient stoves, known locally as jikos, for cooking. To start of with, it was giving each family involved Sh 2,200 per month. A personal carbon emission trading offered a financial carrot to individuals or families to get them to clean up their act. The farmers involved in the project would be allowed to emit only a specified amount of carbon dioxide measured according to pre-agreed scale. If they cut their emissions below this limit, the balance was calculated in monetary terms and they are paid for it. The carbon credits payment was then in its trial stage. Carbon Manna would subsidise the purchase of the jikos in Kenya. This project falls under CDM executed in developing countries that cannot afford the technology required to lower carbon emissions.

In 2012, Carbon Manna Unlimited was pushing forward an ingenious pilot project that rewards small scale farmers in Mbeere and Bungoma districts for planting trees and using more energy efficient stoves, known locally as jikos, for cooking. To start of with, it was giving each family involved Sh 2,200 per month. A personal carbon emission trading offered a financial carrot to individuals or families to get them to clean up their act. The farmers involved in the project would be allowed to emit only a specified amount of carbon dioxide measured according to pre-agreed scale. If they cut their emissions below this limit, the balance was calculated in monetary terms and they are paid for it. The carbon credits payment was then in its trial stage. Carbon Manna would subsidise the purchase of the jikos in Kenya. This project falls under CDM executed in developing countries that cannot afford the technology required to lower carbon emissions.

The

company, which is awarded credits for emitting less carbon in the market,

recently received over 18,000 carbon credits from the redevelopment of Tana

Hydro Power Station. Carbon is now being tracked and traded like any other

commodity and any company can buy the credits from someone else to reduce their

carbon emission footprint.

Benefit Sharing in

Carbon Credit Schemes

Benefit

sharing refers to the fair and equitable distribution of the benefits arising

out of the utilization of a resource. Because indigenous cultures and

livelihood systems are totally dependent on the environments in which they are

found, carbon credit schemes should strive not to negatively impact the rights

of indigenous communities. Unfortunately, not only have communities been

evicted to pave the way for renewable energy carbon credit schemes like

geothermal power generation, but they also rarely benefit beyond mere

compensation, at government determined rates, for the land compulsorily

acquired for such projects. For those

who are given alternative land for settlement, Resettlement Action Plans rarely

consider the sustainability of the community’s cultures and livelihood

system. Carbon project developers

consider benefit sharing only within the context of corporate social

responsibility and not as a community entitlement.

How to share

benefit accrued from Carbon Credit:

Forest

carbon projects in Kenya have yet to raise serious concerns, as they approach

benefit sharing differently. In the

national REDD+ context, benefit sharing has been brought to the forefront,

focusing on both carbon and non-carbon benefits. The design of the REDD+ strategies has so far

included strong community participation in REDD+ benefit sharing discussion.

Benefit sharing accruing from forest carbon projects will be both financial and

environmental. According to the UNREDD

program, financial benefits from forest carbon projects will be based on

project performance with projects that secure more carbon while respecting

rights that are more attractive to buyers.

Laws Regulating Carbon Trade in Kenya

For

benefit sharing, Section 26 of the Natural Resource (Benefit Sharing) Bill,

2014 proposes the establishment of a Benefit Sharing Authority,

whose functions will include “coordinating the preparation of

benefit sharing agreements between local

communities and affected organizations. The Authority shall also “review, and

where appropriate, determine the royalties payable by an affected organization

engaged in natural resource exploitation.” The bill states that:

(1) The revenue collected shall be shared as

follows —

(a) twenty per cent of the revenue collected

shall be set aside and shall, subject to subsection (2), be paid into a

sovereign wealth fund established by the national government; and

(b) eighty per cent of the revenue collected

shall, subject to subsection (3), be shared between the national government and

the county governments in the ratio of sixty per cent to the national

government and forty per cent to the county governments.

(2) The monies paid into the sovereign wealth

fund under subsection (l)(c) shall be paid into the following funds

constituting the sovereign wealth fund as follows -

(a) sixty per cent of the monies shall be paid

futures fund; and

(b) forty per cent of the monies shall be paid

natural resources fund.

(3) At least forty per cent revenue assigned to

the county governments under subsection (l)(b) shall be assigned to local

community projects and sixty per cent of that revenue shall be utilized in the

entire county.

(4) Where natural resources bestride two or more

counties, the Authority shall determine the ratio of sharing the retained

revenue amongst the affected counties.

(5) In determining the revenue sharing ratio of

retained revenue amongst counties sharing a resource as prescribed under

subsection (4), the Authority shall take into account -

(a) the contribution of each affected county in

relation to the resource,

(b) the inconvenience caused to the county in the

exploitation of the natural resource; and

(c) any existing benefit sharing agreement with

an affected organization.

EXPORT MARKET

OPPORTUNITY FOR KENYAN COMPANIES

Given the Kenyan forest cover of 6.9, Large water bodies and vast expanses of land, there a big opening of lucrative investments in green economy. Take for example Kakamega Forest with the following statistics. The total amount of carbon that can be sequestered by the undisturbed indigenous forest is 334Mg C/ha while of the surrounding farms is 203Mg C/ha. This gives a total of 537Mg C/Ha. It is notable that indeed the forest has a higher amount of carbon as compared to the farms.

Challenge: Lately, the price

of carbon credits has been on a downward trend internationally. This has hurt

earnings of companies such as power producer KenGen, which have invested

heavily in environment-friendly projects that have lower carbon emissions in

the race to end global warming. KenGen targeted to earn Sh1.2 billion annually

from trading in carbon credits.

Cause: When Europe’s industrial production stalled

after the 2009 financial crisis, supply quickly dwarfed demand, driving the

credits to their lowest level. Now, KenGen is looking for new markets outside

Europe.

OTHER SECTORS WHERE

CARBON CREDIT HAS BEEN APPLIED IN KENYA

Agriculture: Farms

in Western Kenya

Sustainable

Agriculture Land Management project in Kenya , which, since 2009, has been

working with thousands of smallholder farmers to increase their use of

sustainable agriculture land management practices. The project, is supported by

the World Bank Group’s BioCarbon Fund in partnership with the Swedish NGO Vi Agroforestry.It

aims to support a total of 60,000 farmers managing 45,000 hectares of farmland

in western Kenya.

It has

trained farmers on how to sustainably rehabilitate degraded lands to increase

crop yields and farm productivity. On average, farmers saw maize yields more

than double during the project, leading directly to higher incomes.

Wildlife: Kasigau Community

Kenya is

one of 53 nations partnering with the UN-REDD program (short for Reducing

Emissions from Deforestation and Forest Degradation), and Wildlife Works's

Kasigau project is the country's pilot carbon offset initiative adapted for

wildlife management in partnership with the community. The Wildlife Work's

rangers monitor more than 500,000 acres of wooded land in the Kasigau

Corridor—a stretch between Tsavo East and Tsavo West national parks containing

more than 110,000 inhabitants—to prevent illegal tree-cutting and keep elephant

poachers at bay.

CONCLUSION:

Clean

mechanism development (green projects) costs are high and given the lack of

access to capital by individuals as well as general lack of information, carbon

credit trading has mainly been dominated by companies rather than individual investors.

Despite this, It is important to note that carbon

credit schemes will play an important role in both climate change adaptation

and mitigation not only in Kenya but also in other parts of the world.

There is still wide untapped opportunities that if seized by "green"

investors, as company or individual,

would go along way in mitigating climate change, deforestation,pollution of

marine life, degradation of soil ,hence collectively curbing the harsh effects

of global warming which is a big menace to both fauna and flora of this

beautiful earth. Together we can bring the most desired change. Do that little

thing in you own way.

REFERENTIAL LINKS

Forest

Forest service/carbon credit credit http://www.kenyaforestservice.org/index.php/2016-04-25-20-08-29/news/302-forest-carbon-credits.

Worldbank

press release http://www.worldbank.org/en/news/press-release/2014/01/21/kenyans-earn-first-ever-carbon-credits-from-sustainable-farming

Worldbank

News

http://www.worldbank.org/en/news/feature/2017/07/18/kenya-project-boosts-maize-production-and-climate-change-benefits

http://www.worldbank.org/en/news/feature/2017/07/18/kenya-project-boosts-maize-production-and-climate-change-benefits

Standard

media /kengen to trade on carbon credit https://www.standardmedia.co.ke/article/2000172369/kengen-to-trade-its-carbon-credits-on-local-bourse

Business

daily http://www.businessdailyafrica.com/Nairobi-bourse-plans-platform-for-trading-in-carbon-credits/539552-3059574-n70ji6z/index.html

Standard

Media https://www.standardmedia.co.ke/business/article/2000208079/government-to-support-nse-introduce-carbon-credits-trading

Kenya Draft

Policy On Carbon Trade http://www.nation.co.ke/lifestyle/smartcompany/Kenya-drafts-policy-on-carbon-trading/1226-1493718-dpjcj4z/index.html

Kenya

carbon credit tree protection program http://www.v-c-s.org/kenya-carbon-credit-tree-protection-program-grow-fivefold/

UN-REDD

PROGRAMME, CARBON RIGHTS AND BENEFIT-SHARING FOR REDD+ IN KENYA 8 (2013)

[hereinafter BENEFIT-SHARING FOR REDD+ IN KENYA], available at http://www.kenyaforestservice.org/documents/Carbon%20Rights%20and%20Benefit%20S harring%20For%20REDD%20in%20Kenya.pdf.

Natural

Resources (Benefit Sharing) Bill, 2014, KENYA GAZETTE SUPPLEMENT No. 137, available at

http://kenyalaw.org/kl/fileadmin/pdfdownloads/bills/

2014/NaturalResources_Benefit_Sharing_Bill__2014.pdf.